Federalism

Switzerland is a federal state: state power is shared between the federal government, the cantons and the communes. The cantons and communes have broad scope in carrying out their responsibilities. Federalism makes it possible for Switzerland to exist as one entity – in spite of four linguistic cultures and varying regional characteristics.

Video Federalism (in German)

1

Switzerland, which is also referred to as the Swiss Confederation, has been a federal state since 1848.

Confederation

The Federal Constitution defines the Confederation’s tasks and responsibilities. These include Switzerland’s relations with the outside world, defence, the national road network, and nuclear energy. Switzerland’s Parliament, the Federal Assembly, is made up of the National Council and the Council of States; the government comprises seven federal councillors, and the Federal Supreme Court is responsible for national jurisprudence. The Confederation is financed among other means through direct federal tax.

11 per cent of all Swiss citizens live outside

Switzerland (the ‘Swiss Abroad’).

Proceeds from direct federal taxation

account for 34 per cent

of the Confederation’s total revenues.

26

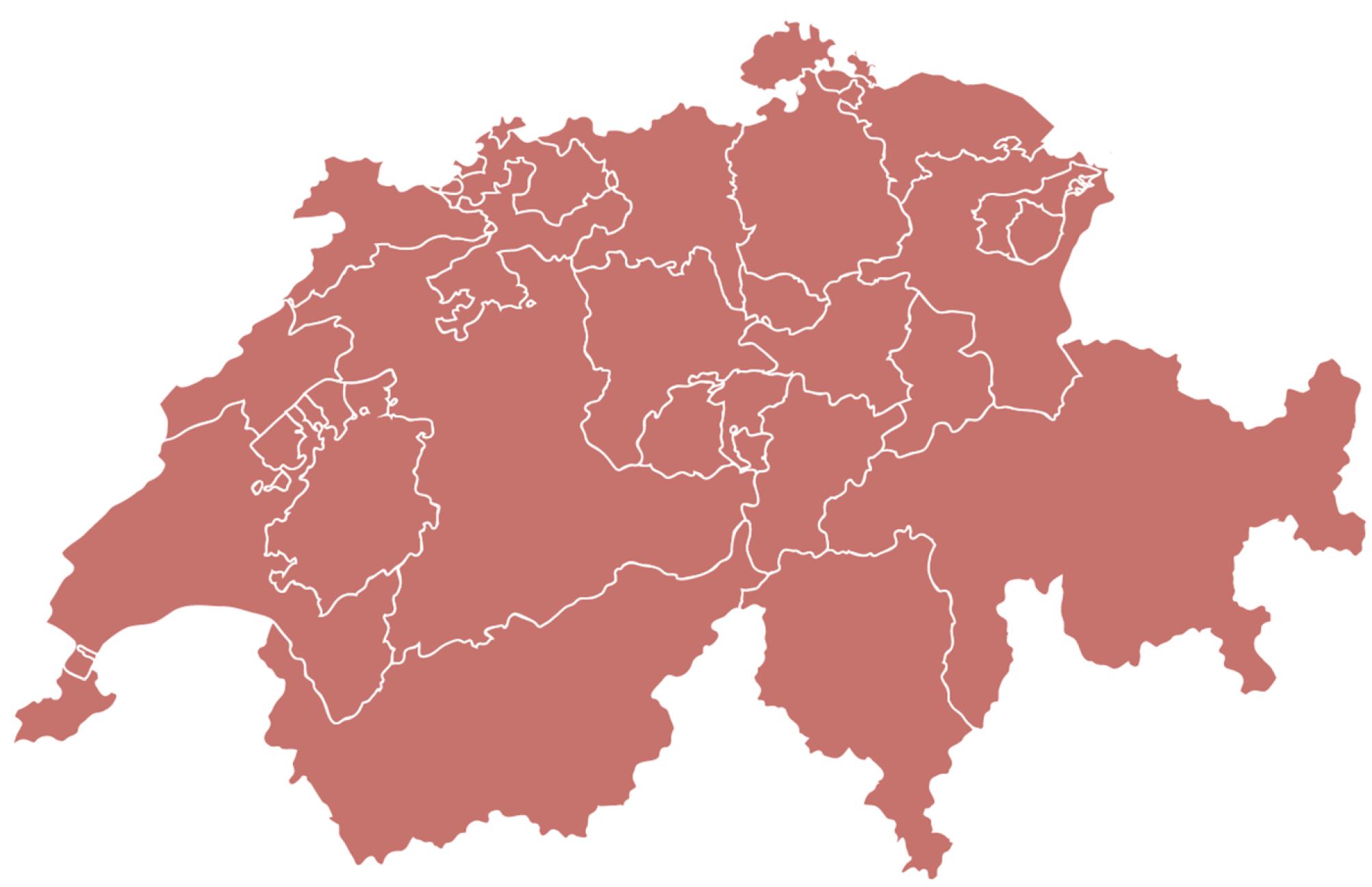

The Confederation is made up of 26 cantons.

Cantons

Each canton has its own

parliament, government, courts and constitution. The cantonal constitution may not contradict the Federal Constitution. The cantons implement the requirements of the Confederation, but structure their activities in accordance with their particular needs. They have broad scope in deciding how to meet their responsibilities, for example in the areas of education and healthcare, cultural affairs and police matters. Each canton levies its own cantonal taxes.

Four cantons are officially multilingual: Bern,

Fribourg and Valais have two official languages, Graubünden even has three.

People’s

assemblies (Landsgemeinde) are still held in the cantons of Appenzell

Innerrhoden and Glarus.

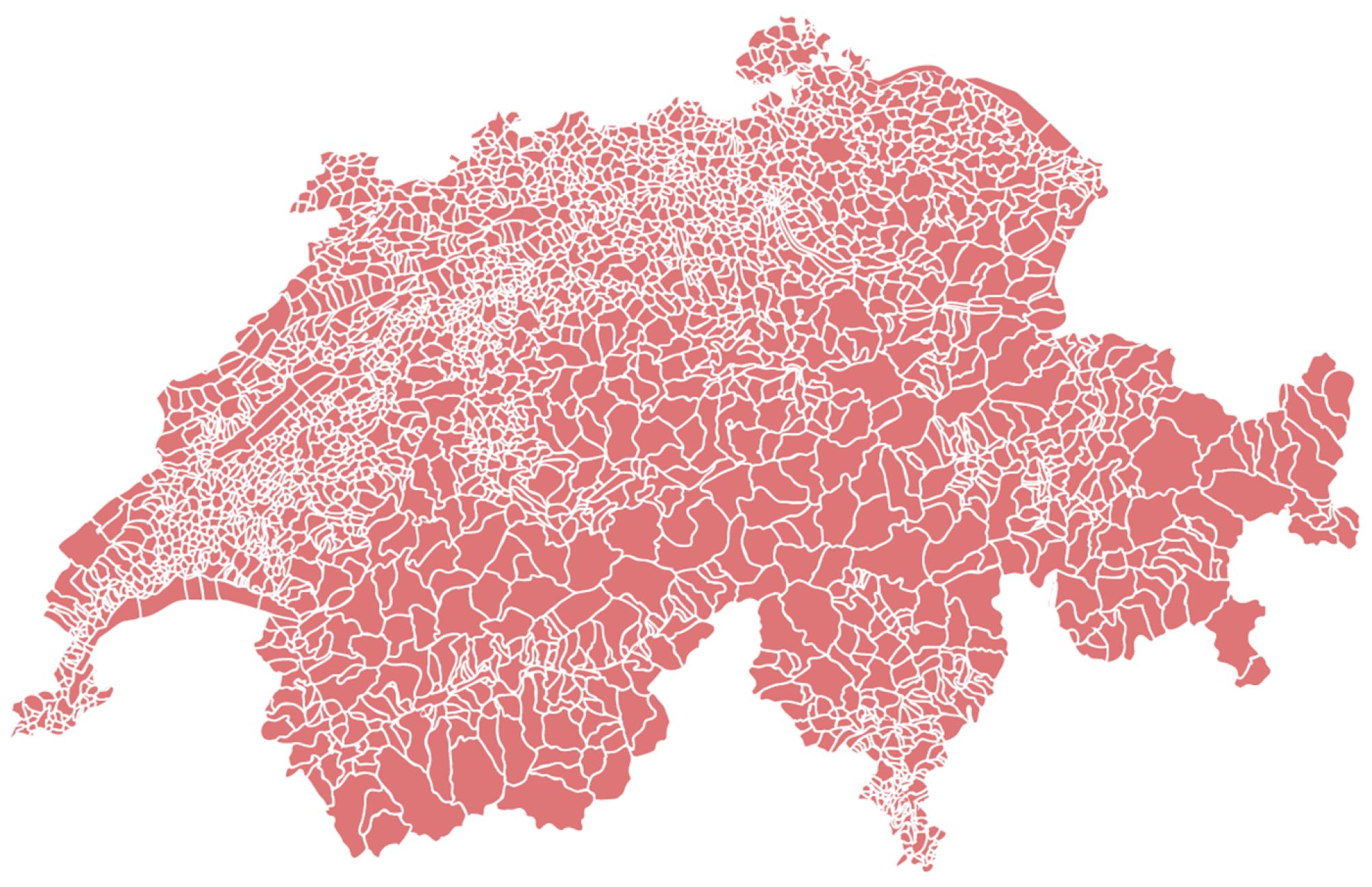

2148

The 26 cantons are divided into 2148 communes.

Communes

Each canton determines

itself the division of responsibilities between it and the communes. The responsibilities of the communes include local planning, running the schools, social welfare and the fire service. Larger communes and cities have their own parliaments, and organise their own referendums. In smaller communes, decisions are made by the citizens at communal assemblies. Each commune levies a communal tax.

The smallest commune (Kammersrohr, SO) has a population of 32, the largest approximately 420 000 (City of Zurich).

An average of approximately 30 communes merge every year, thereby reducing the total number of communes.

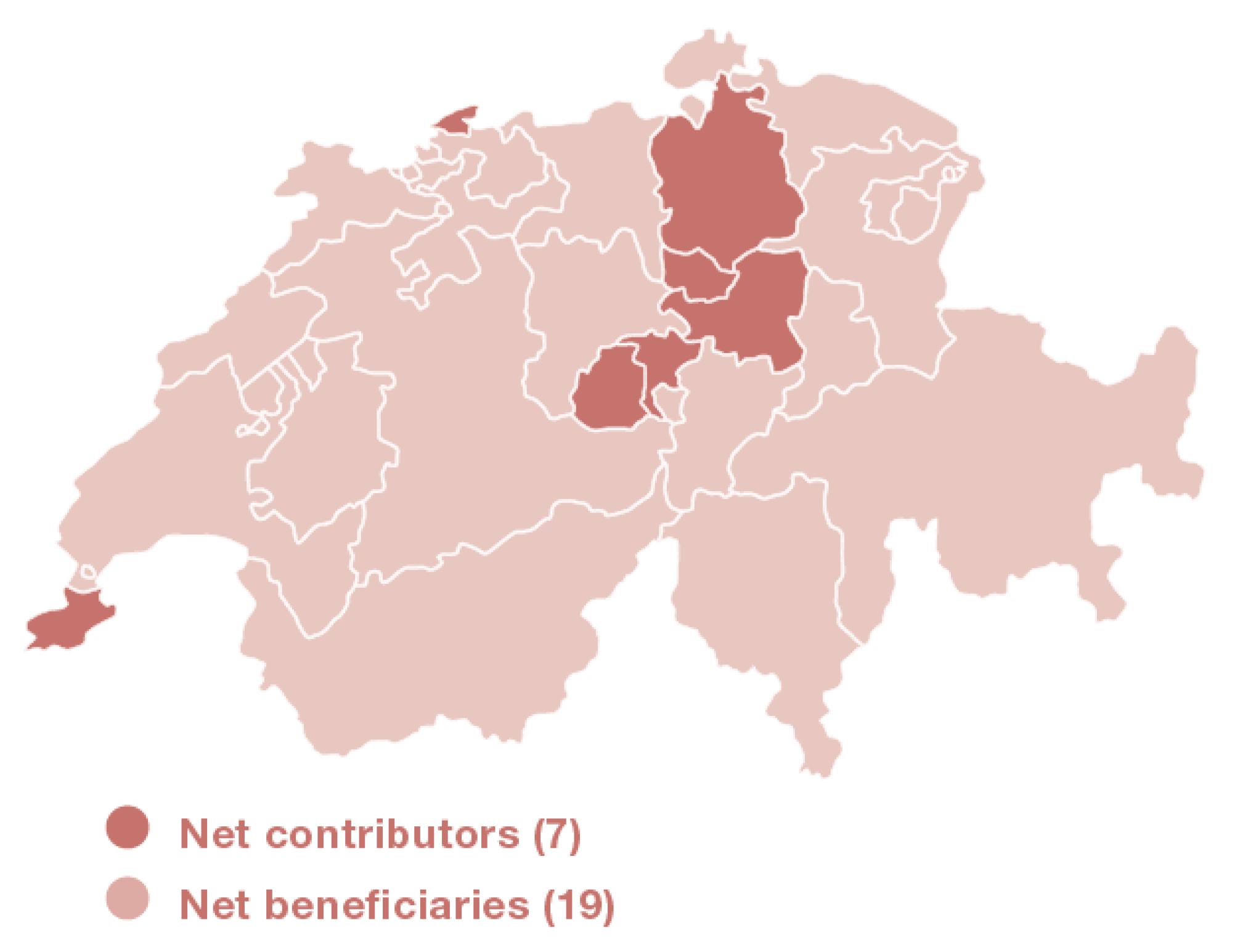

The National Fiscal Equalisation system

The National Fiscal Equalisation system is an important instrument in ensuring Switzerland's cohesion and reflects its desire for solidarity. The economically stronger cantons and the federal government assist the financially weaker cantons.

When it comes to

fulfilling their tasks, each canton starts with a different set of

circumstances: there are smaller, larger, more urban, more rural and more

mountainous cantons. The National Fiscal Equalisation system is designed to

reduce the economic disparities between the cantons.

The federal government and

seven of the cantons are net contributors: ZG, SZ, NW, GE, BS, ZH, OW.

The remaining 19 cantons receive equalisation payments.

In 2020, CHF 5.3bn flowed

into the fiscal equalisation system: 3.5bn from the federal government, 1.8bn

from the cantons.

The examples of Jura and Zug

The Canton of Jura, which

is financially weaker, receives CHF 167m in fiscal equalisation, or CHF 2297

per inhabitant.

The Canton of Zug, which is financially stronger, contributes CHF 330m, or CHF

2685 per inhabitant towards fiscal equalisation.

Further information about fiscal equalisation