The Government

The

Federal Council is Switzerland’s government. It consists of seven members, who take decisions and defend their decisions in a

collegial manner. The presidency rotates every year. The Federal Council is assisted

in its tasks by the Federal Administration. The Administration is made up of seven

departments and the Federal Chancellery. The Confederation’s expenditure may

not exceed its receipts over the longer term: this is ensured by the debt brake

mechanism.

Federal finances: checked and approved

The Federal Constitution sets out what taxes the Confederation is

allowed to raise. Maximum tax rates are defined for the main sources of receipts,

namely direct federal tax and value added tax. These may only be modified if a

majority of the People and the cantons agree. Parliament has

sovereignty over federal finances: it decides the budget and approves the state

financial statement of the previous year.

Debt

brake mechanism

The Confederation is required

to balance its expenditure and receipts over the longer term. It is required to

run a surplus when the economy is thriving and may spend more than it collects

in receipts when the economy is weak.[2]

The debt brake does allow for an exception to be

made in extraordinary crisis situations such as serious recessions and natural

disasters; the government may then undertake additional expenditure.

COVID-19

The pandemic that has been

raging around the world since early 2020 has had a significant impact on the

state of federal finances. To support the economy and the people, the Federal

Council and Parliament have taken a series of measures costing several billion

francs. At the same time, the Confederation is expecting lower tax revenues

than usual. Thanks to the low level of government debt, Switzerland and the Confederation in

particular are in a solid position.

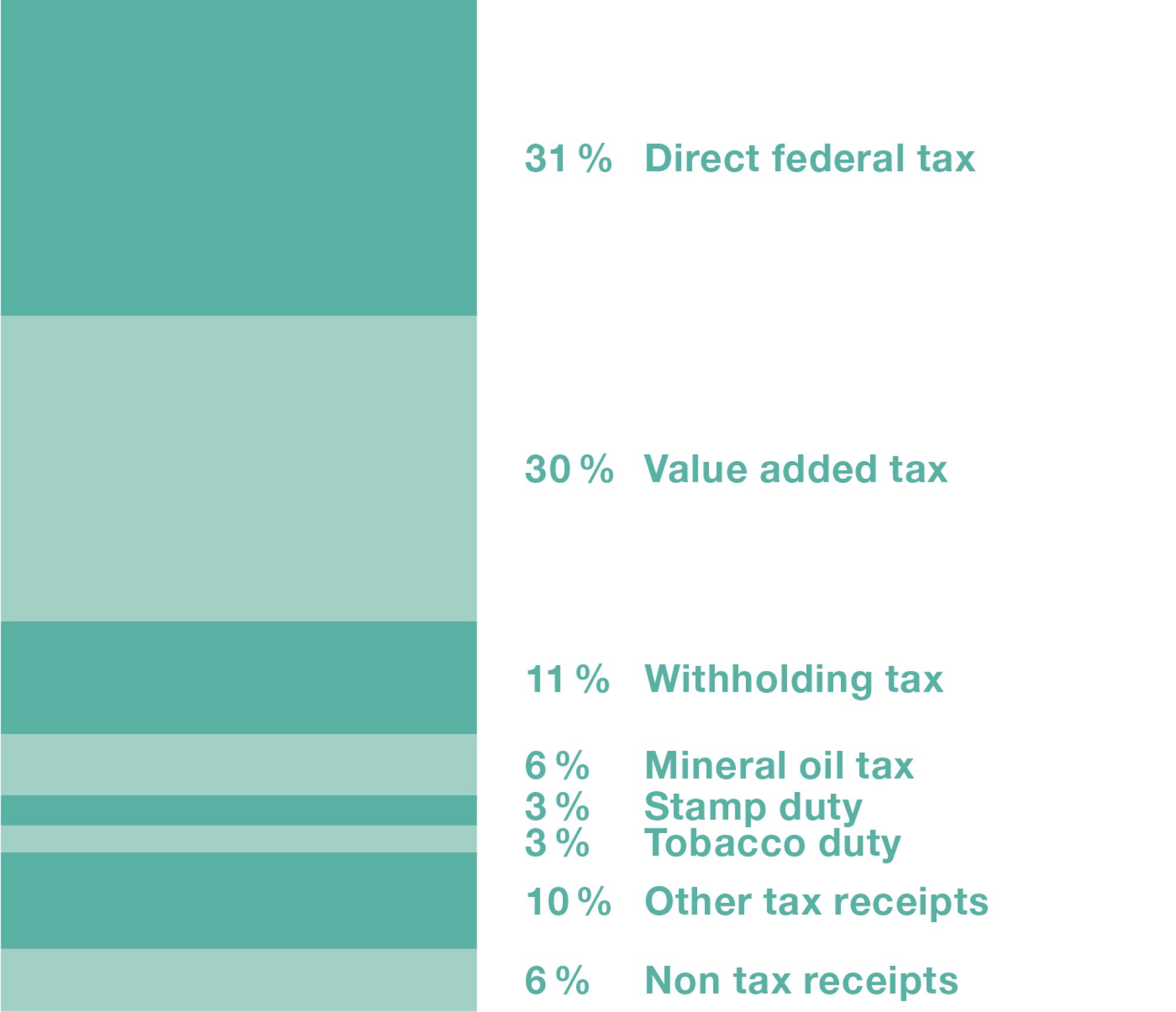

Federal receipts and expenditure (2019)

Receipts of 74.5 billion

Direct federal tax and VAT are

the Confederation’s main sources of receipts. Direct federal tax is raised on

the income of private individuals (progressive, max. 11.5%), and on business

profits (8.5%). VAT is 7.7% on most goods and services.

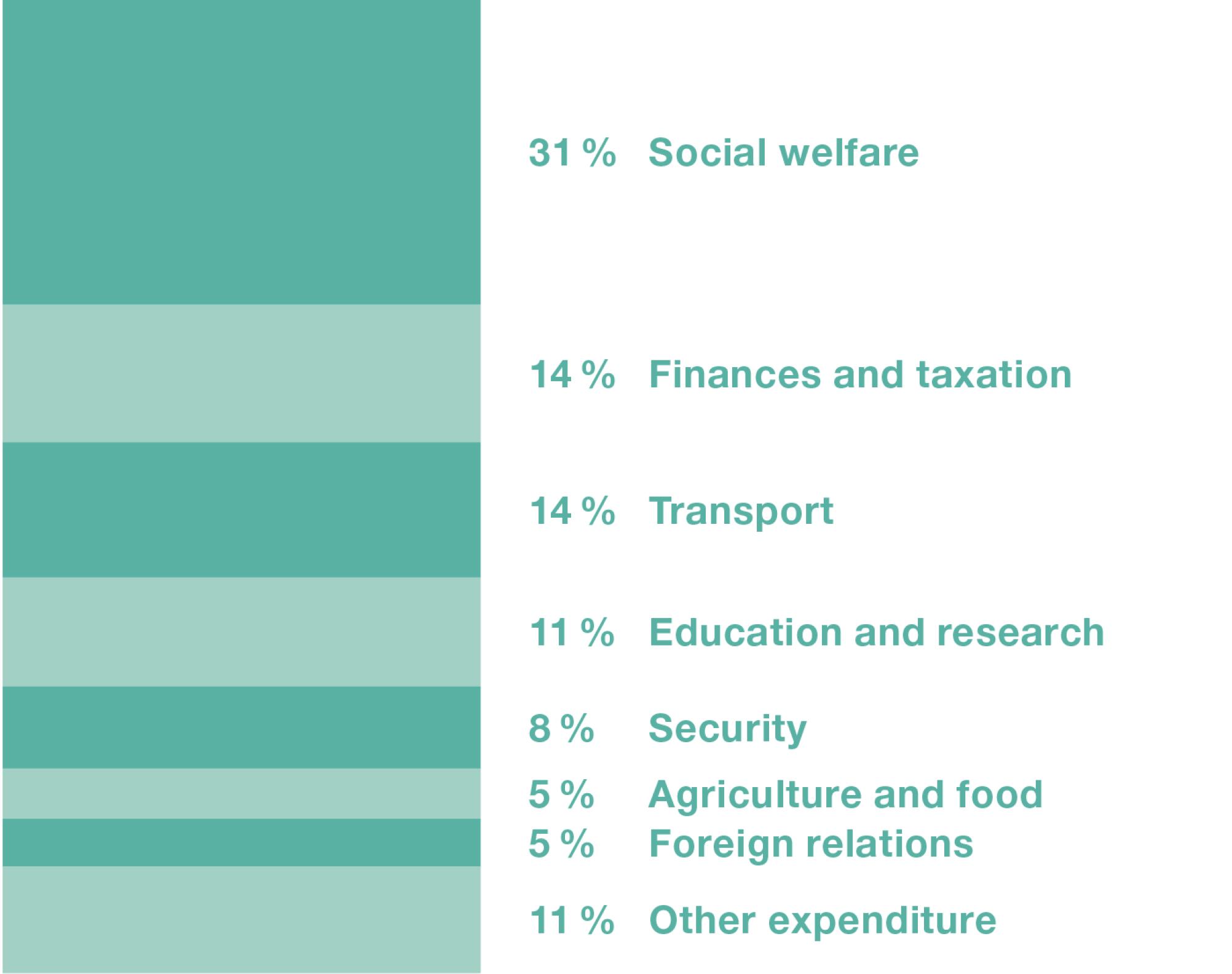

Expenditure of 71.4 billion

Almost a third of federal expenditure goes towards social welfare. Half

of that goes towards old age pension provision (OASI), and a sixth to invalidity

insurance (II). Other major areas of expenditure are supplementary benefits, health

insurance premium reductions, and migration.

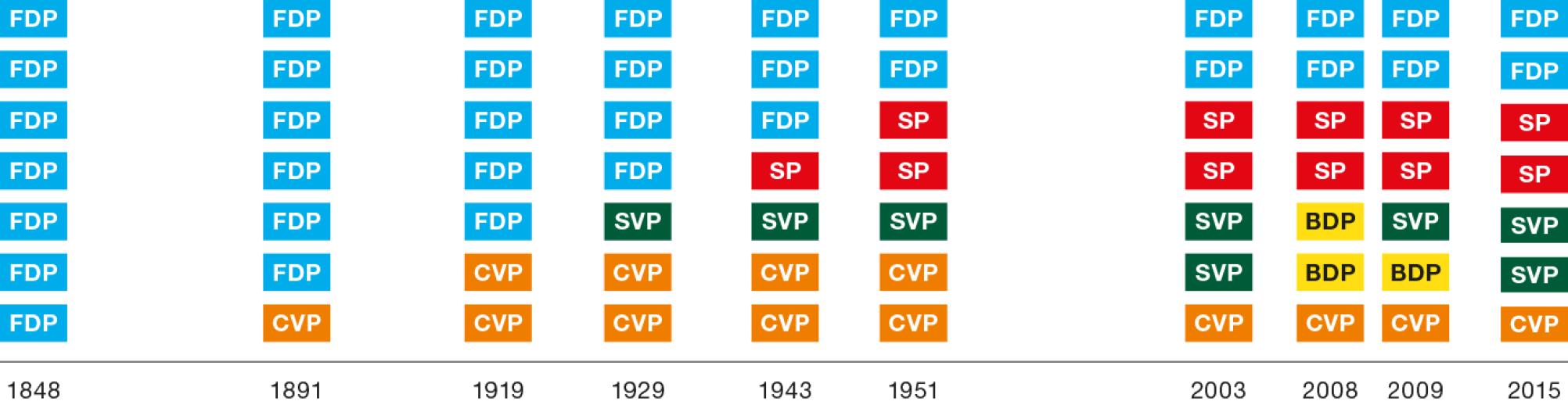

Political party composition of the Federal Council since 1948

1848

The Federal

Council was composed of seven members of the Free Democratic Party (today FDP.The

Liberals). The party governed alone for 43 years.

1891

The first member of the

Catholic Conservatives (today CVP) joined the government; the second joined in 1919.

1929

Parliament elected a member of the Farmers’, Trades’

and Citizens’ Party (today SVP) to the Federal Council.

1943

The first Social

Democrat (SP) entered the government; the second followed in 1951.

1959

The four strongest parties agreed to form a

government by applying the ‘magic formula’:

2 FDP, 2 CVP, 2 SP,

1 SVP. The formula remained unchanged for 44 years.

2003

At the Federal

Council elections, the SVP won a seat at the expense of the CVP.

2008

The two

representatives of the SVP joined the newly founded Conservative Democratic

Party (BDP).

2009

A member of the SVP was elected in place of a

retiring BDP representative.

2015

The BDP

representative stepped down. Parliament elected an SVP representative in her

place.

Since then

The Federal Council has again been composed of members from four different

political parties – according to the 2:2:2:1 formula.